4th March 2024

Huge opportunity for natural catastrophe reinsurance industry with over 500 billion USD of uninsured losses in China between 2012-2022

In an exclusive interview with China Daily, Joachim Wenning, Chair of the Board of Management of Munich Re emphasized the growth potential of the catastrophe reinsurance business in China. He stated that about 5 percent of natural catastrophe risks in China currently are covered by insurance or reinsurance, which he says is far below the global average ratio of around 38 percent.

hei-risk data has looked at the economic losses caused by natural disasters from 2012 to the latest report for 2022 produced by the China Statistical Yearbook to try and quantify this potential area of growth.

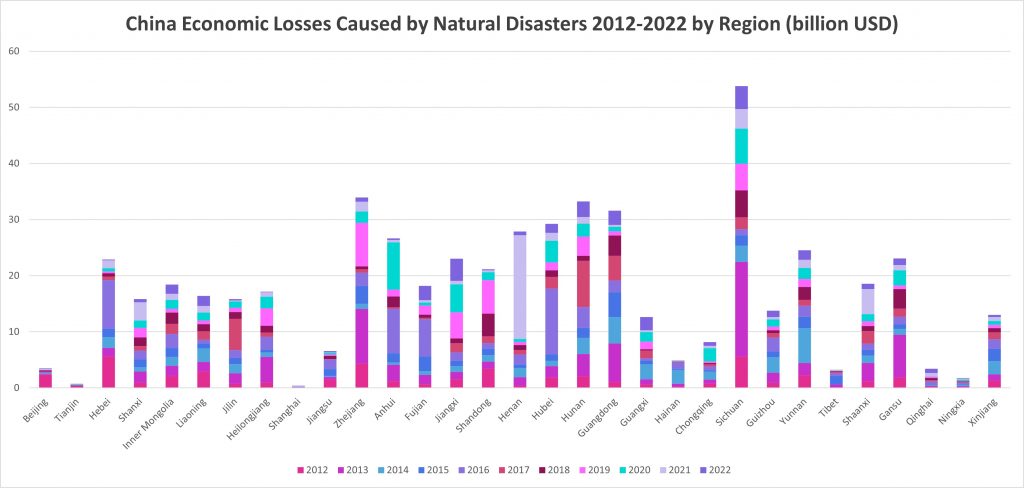

China is a vast country and consequently is vulnerable to a variety of environmental hazards (such as floods, earthquakes and typhoons) affecting different regions. The map below illustrates how the losses caused by natural catastrophes have accumulated at a regional level over a 10-year period (2012-2022).

Examining the data further at a region level, the chart below identifies Sichuan province as the region with the greatest losses caused by natural disasters of about 53.8 billion USD (384.3 billion yuan), the major contributing factor being the 2013 earthquake which severely affected this region.

Source: China Statistical Yearbook

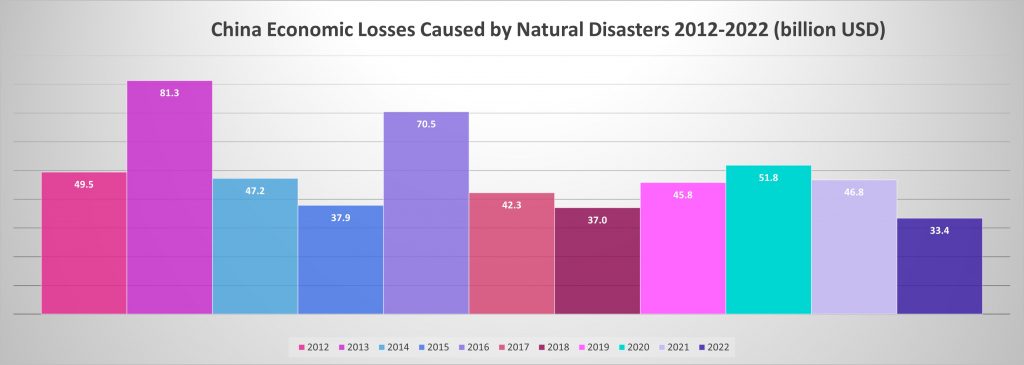

Over the 10-year period China has recorded around 543.4 billion USD (3,881.5 billion yuan) of economic losses caused by natural catastrophic events. The chart below, illustrates how each year compares during this period (2012-2022)

Source: China Statistical Yearbook

Using this data, assuming roughly 5% of market penetration that would mean 27.2 billion USD (194 billion yuan) over the last 10 years are insured losses, this leaves an enormous untapped potential market for the catastrophe reinsurance market of around 516.2 billion USD (3,687 billion yuan) of losses that weren’t covered in this 10-year period.

China, a country with the highest population, the world’s second strongest economy combined with its exposure to multi-peril environmental risks (earthquakes, floods, landslides and typhoons) and with its relatively low reinsurance market penetration are all factors that point towards China as a market with huge potential for the catastrophe reinsurance business.

hei-risk data has available detailed 1km high resolution China exposure databases which can be tailored to clients needs. Such high-quality data is essential to help the reinsurance industry to intelligently manage their risks as they look to broaden their catastrophe coverage.

Please visit China Exposure Database 2023 | hei-risk data for more details and where you can download a free sample of the dataset, or contact aheissig@hei-riskdata.com